Products You May Like

Washington Dc: Internal Revenue Service federal building Washington DC USA. The Internal Revenue Service (IRS) is the revenue service of the United States federal government. The government agency is a bureau of the Department of the Treasury. The

Getty

Is the Internal Revenue Service (IRS) overwhelmed? It’s a question I’ve been mulling as I’ve sat on the phone for longer and longer hold times of late. And it turns out that my experiences may increasingly be the norm. The 2018 IRS Data Book, which was recently published by the agency, offers a snapshot of the agency’s activities for the fiscal year. And the findings indicate that the IRS is busier than ever.

The 2018 IRS Data Book describes what the IRS has been up to – including processing tax returns, issuing refunds, conducting examinations (audits) and enforcing tax laws – for the most recent fiscal year. Fiscal year 2018 started on October 1, 2017, and ended on September 30, 2018; that means that the book does not include data from the most recent government shutdown. And the numbers bear out that even before the shutdown, the IRS was still trying to do more with less.

IRS Data Book 2018

IRS Data Book 2018

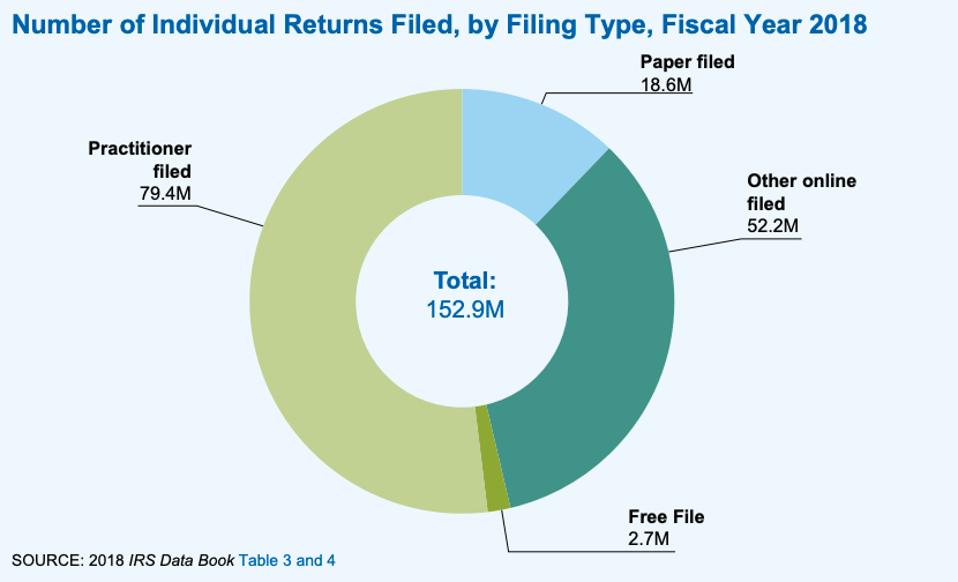

During fiscal year 2018, the IRS collected nearly $3.5 trillion in tax this year, representing 95% of all federal revenue. The agency processed more than 250 million tax returns and other forms – mostly filed by tax practitioners – and issued over 120 million individual income tax refunds totaling almost $395 billion. The lion’s share of those processed returns, as noted in the chart above, were individual income tax returns.

If you’re wondering how that compares to other years, the IRS reported that it “received and processed more of every major type of form during FY 2018 than during the prior year” with the exception of one kind of return: federal estate tax returns (even with the huge jump in exemption amounts, those filings were down just under 1%).

The IRS website and apps were busy, too. There were more than a half-billion visits (608,776,283 visits resulting in 3,219,660,310 page views) to IRS.gov. There were also more than 309 million inquiries to the “Where’s My Refund?” application, up 11% compared to the prior year and nearly 5 million “Where’s My Amended Return” inquiries. Taxpayers flocked to the site for other online tools, too, with the IRS fulfilling over 80 million Transcript Delivery System (TDS) requests (you can find more on the transcript tool here).

IRS employees were also in demand. According to the Data Book, IRS employees helped more than 64.8 million taxpayers through correspondence, toll-free telephone helplines or at Taxpayer Assistance Centers. Phone waits were still long, with nearly a quarter of all calls going unanswered. Those that did get through waited an average of 7.5 minutes; wait times are typically better during the tax season when IRS hires seasonal workers (those of us who call year-round are more used to the hour-and-a-half hold times like the one I experienced earlier today).

IRS Commissioner Chuck Rettig said, about the data, “Our employees are the backbone of this agency, delivering our mission efficiently and effectively. They work hard to help taxpayers, and the numbers outlined in the Data Book reflect their commitment.”

The numbers of audits of individual taxpayers were down, as were the numbers of IRS liens filed. But net revenue from delinquent collection activities increased to $40 billion, an upward tick of 1.6% compared to the prior year, and IRS levies were up by a whopping 8.35% compared to the preceding year.

(By way of information, a lien acts as a placeholder which protects the government’s interest by putting creditors on notice that the government has a legal right to property. A levy means that the government is taking action to seize property to pay a tax debt (you can find out more about levies here).

More than 3.5 million tax returns were prepared through the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs this year. To get that work done, the IRS relied on 86,646 volunteers at 11,044 sites. (You can find out more about VITA here).

The Data Book also revealed results of the 2018 Comprehensive Taxpayer Attitude Survey (CTAS) based on feedback from taxpayers (the CTAS has been doing this since 1999). The results of the survey indicate that most taxpayers continued to agree (95% mostly or completely) that it’s their civic duty to pay their taxes with 85% of taxpayers saying that it is not at all acceptable to cheat on their income taxes; 10% said it was okay to cheat a little here and there and 3% said that it was fine to cheat “as much as possible” on their taxes (thus ensuring that tax attorneys and other tax professionals will continue to find work).

The Data Book includes dozens of charts and tables outlining the tax agency’s findings. You can download the 2018 IRS Data Book as a PDF here. If you want a printed copy, Publication 55-B, will be available in June of 2019 from the U.S. Government Printing Office: just write to the Superintendent of Documents, P.O. Box 371954, Pittsburgh, PA 15250-7954, call 202-512-1800 or fax a request to 202-512-2250.